Pictured at the 2019 Year in Review event, from left to right: PCF President & CEO Jennifer DeVoll, Finance Committee member Phyllis Crandon, Finance Committee Chair Sandra Ell, and CJ Dennis, Senior Investment Consultant with Vanguard Institutional Advisory Services

Pictured at the 2019 Year in Review event, from left to right: PCF President & CEO Jennifer DeVoll, Finance Committee member Phyllis Crandon, Finance Committee Chair Sandra Ell, and CJ Dennis, Senior Investment Consultant with Vanguard Institutional Advisory Services

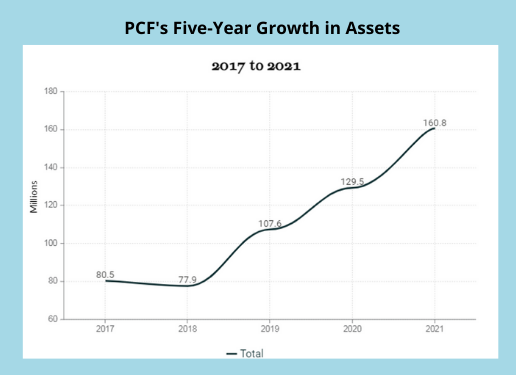

Pasadena Community Foundation hosted its annual Year in Review Investment Briefing on Zoom on Tuesday, February 1, led by PCF Finance Committee Chair Sandra Ell and CJ Dennis, Senior Investment Consultant with Vanguard Institutional Advisory Services. PCF’s fund holders were happy to learn that PCF’s annual portfolio performance was strong, leading to PCF’s impressive year-end total of $160.8 million in assets and 400+ charitable funds.

2021 Growth Metrics

PCF offers Fund Holders three portfolio investment options. 2021 returns were as follows:

- PCF’s Long-Term Portfolio 13.17%

- PCF’s Moderate Portfolio 9.74%

- PCF’s ESG Portfolio (socially responsible) 15.19%

Of its current assets, $107 million serve as the Foundation’s “Funds for Pasadena,” or assets directly benefiting grantmaking for the greater Pasadena area. In 2021, PCF awarded $8.8 million in total grants.

Deep Expertise Guides PCF’s Portfolio and Finance Committee

Vanguard has managed PCF’s assets for nine years as part of its $8.5 trillion in assets worldwide. CJ Dennis as been with Vanguard for 16-years and serves as the lead consultant for Vanguard’s largest community foundation clients. PCF fund holders always appreciate his engaging snapshot of the national market and PCF’s portfolio returns.

Sandra Ell, the chair of PCF’s Finance Committee, is a licensed CPA in the State of California and served in finance and investment management for 25 years at Caltech. She was promoted to Chief Investment Officer by Caltech’s Board of Trustees in 1998 and served until October 2010. At Caltech, she managed approximately $2 billion in investment funds, the university’s real estate portfolio, and a staff of investment professionals. Sandra shared with the Zoom audience information about PCF’s Finance Committee and the deep expertise of its 11 members.