Gifts of Real Estate

Have you or your clients considered gifts of real estate?

Real estate assets can be impactful philanthropic gifts and generate tremendous tax savings for sellers.

If you are considering the sale of income property, a family home, or other investment holdings, explore the possibility of gifts of real estate in partnership with Pasadena Community Foundation.

Charitable Gifts of Real Estate:

- Create transformative philanthropy

- Provide significant tax benefits

- Fund Charitable Gift Annuities for lifetime income

PCF works closely with donors to structure the terms of their gifts and with real estate agents to plan and execute the sale of property once the donation is complete. We hold all real estate as assets of a supporting organization within the Foundation, for the greatest flexibility, due diligence, and stewardship of the gift process.

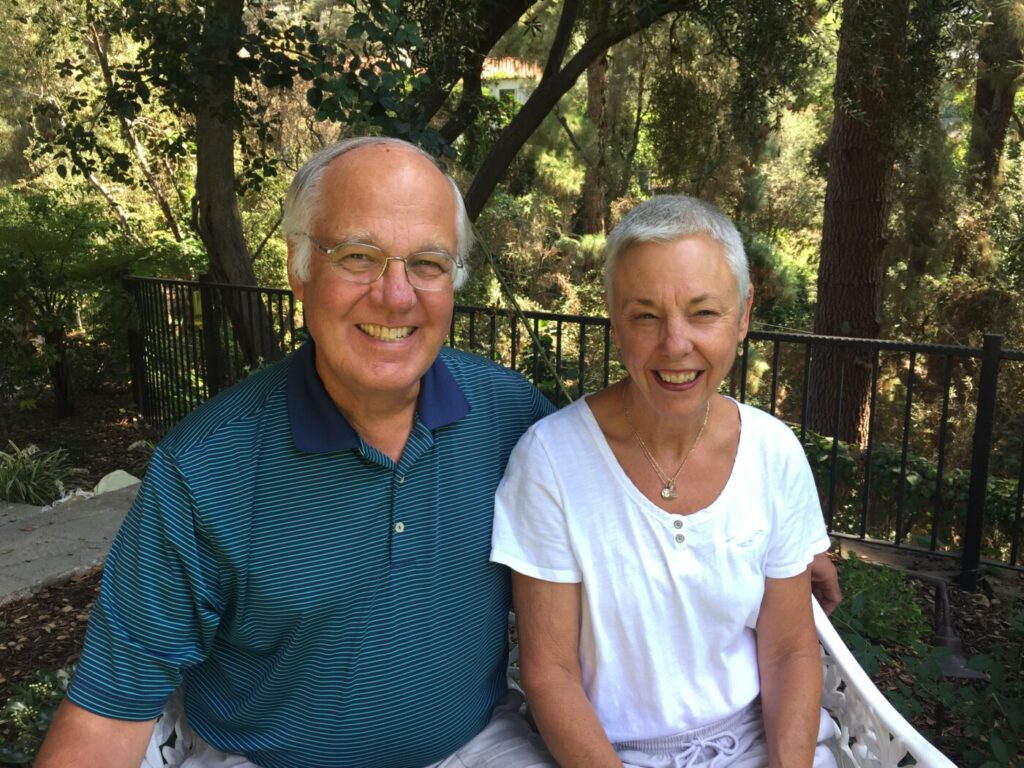

A Gift of Real Estate Becomes the Merchant Family Foundation

Edward (“Ted”) and Betsy Merchant have deep roots in Pasadena and a commitment to the wellbeing of their community. In 2012, the Merchants purchased a three-bedroom house on South San Marino Avenue as a rental property for Ted’s sister. It was her home for nine years before she moved away in early 2022. “We wondered what to do with it,” Ted notes, “before realizing that if we gave it away to a nonprofit, we could realize a tax break.” With the help of their accountant Tony Gronroos, a managing partner with HKG in Pasadena, the couple reached out to PCF.

PCF worked closely with Ted and Betsy to coordinate the gift of the property to the Foundation. Once the legal work was complete, PCF listed the property, which sold within two weeks. The proceeds funded a new donor advised fund, which the family named the Merchant Family Foundation. It allows the Merchant family to make gifts to their favorite nonprofit organizations in the coming years. “The process was just ridiculously straightforward and easy, which is one of the things that sold us on PCF,” according to Ted. “PCF staff was incredibly helpful.”

For more information on gifts of real estate, please contact Liz Algermissen (626) 796-2097, ext. 105 or ealgermissen@pasadenacf.org.